The minimum income amount depends on your filing status and age. If your income is below that threshold, you generally do not need to file a federal tax return. Review the full list below for other filing statuses and ages. Please see IRS Publication for additional information. Although your income may be below the minimum income to file taxes taes shown above, you may not have to file taxes, but there may be times when you want to file a return. Find out if you qualify for tax benefits. If you are lucky enough to have your student loans paid off by someone else, you may have to think about the tax implications. All Rights Reserved. Check the box below to get your in-office savings. I am not a robot.

Plastic Yandex.Money Card

Not everyone is required to file an income tax return each year. Generally, if your total income for the year doesn’t exceed certain thresholds, then you don’t need to file a federal tax return. The amount of income that you can earn before you are required to file a tax return also depends on the type of income, your age and your filing status. Most taxpayers are eligible to take the standard deduction. These amounts are set by the government before the tax filing season and generally increase for inflation each year. The standard deduction, along with other available deductions, reduces your income to determine how much of your income is taxable. As long as you don’t have a type of income that requires you to file a return for other reasons, like self-employment income, generally you don’t need to file a return as long as your income is less than your standard deduction. In most cases, if you only receive Social Security benefits then you would not have any taxable income and therefore would not need to file a tax return.

Transfers through Western Union

When determining whether you need to file a return and you receive Social Security benefits, you need to consider tax-exempt income because it can cause your benefits to be taxable even if you don’t have any other taxable income. You may want to use TurboTax to help you estimate if you’ll need to file a tax return and what income will be taxable. If you are at least 65 years old, you get an increase in your standard deduction. You also get an increased standard deduction if:. The largest standard deduction would be for a married couple that are both blind and both over 65 years old. Having a larger standard deduction can allow you to have more income than someone under age 65 and still not have to file a return. Again, you may want to use TurboTax to help you estimate if you’ll need to file a tax return and what income will be taxable. It’s free to use, you only pay when you’re ready to submit your tax return. Taxpayers who are claimed as a dependent on someone’s tax return are subject to different IRS filing requirements, regardless of whether they are children or adults.

How Much Money Can You Make Without Paying Taxes?

Obviously, most people do have to file. But if your gross income was low enough last year, you may be off the hook. How low is low enough? See the gross income maximums in the table below which depend on your age and marital status as of Dec. Gross income basically means potentially taxable income from all sources, including income from outside the U.

Happy New Month Fam… while we are looking forward to Celebrating Valentine.. This cars can be yours truly .. Unbeatable prices .. @_DammyB_ @TheJxnnifvr @thatgoddess____ @MoAdekunleOni @Tourller @TheTobiSmith @slimdammie @perfectskones @Otiscollection_ lets go there…

— Lavenda Luxury Wheels NIGERIA (@LuxuryNigeria) February 2, 2020

Do You Need to File a Tax Return?

I just started cleaning houses for some extra money. Do I need to pay taxes on this money? Do you know how much money I can make with out having to pay taxes? Depends on your marital status, number of dependents if any, if you’re a dependent of anyone else, and any other income you or a spouse.

Also depends if you are considered an independent contractor or not. Anything under that you yoy owe taxes. You’d still get a W-2 ,oney your employer at the end of the year showing your income and any withholding. If anything was withheld for income taxes, you would still want to file to get that money.

You might also be eligible for something called the Earned Income Credit which is a program that gives additional money to low income people who are working — if you don’t file, you don’t get.

If you are a dependent of someone else like your parents then the filing limit would be lower. And py you’re considered an independent contractor rather than working for an employer, you’d be responsible for paying both the employee and the employer parts of Social Security and Medicare taxes. The above info is for federal taxes. Depends on what the income is.

It depends on a lot of things like You probably ought to ask someone who is an accountant or works for one in your area, rather than depending on what people say. They may or may not be correct. Yes you do, you must report and pay taxes on All income you receive no matter what it’s source! Trending News. NFL currently ‘won’t allow’ 49ers’ Super Bowl request. Singer falls silent, dies during live performance. Student ylu dead at Stanford University fraternity.

Philip Rivers makes ‘permanent’ offseason. Tragic accident as woman runs to McDonald’s for family. Trump mocks ‘foolish’ plans for NYC sea wall. Late actor’s vehicles garner millions at auction. Do you plan to file an Equifax breach claim? A luxury dish is banned, and a rural county suffers. Answer Save. Judy Lv 7. Aurelia Lv 4. That’s no bulls! How do you think about the answers? You can sign in to vote the answer.

Pobept Lv 6. Grimm Lv 4. Then you have to report Still have questions? Get your answers by asking .

Do Youtubers Pay Taxes????? (USA)

Trending News

Tax season is upon us, yku the deadline only a couple of pzy away. And that deadline will be here before you know it. Getting all of your tax information prepared as early as possible meaning start now if you haven’t is important. But depending on the money you make and how you plan on filing your taxes, there’s another important thing to figure out: do you even make enough money to require filing taxes? It can be a worthwhile question if you’re not making that much money.

2020 Tax Guide

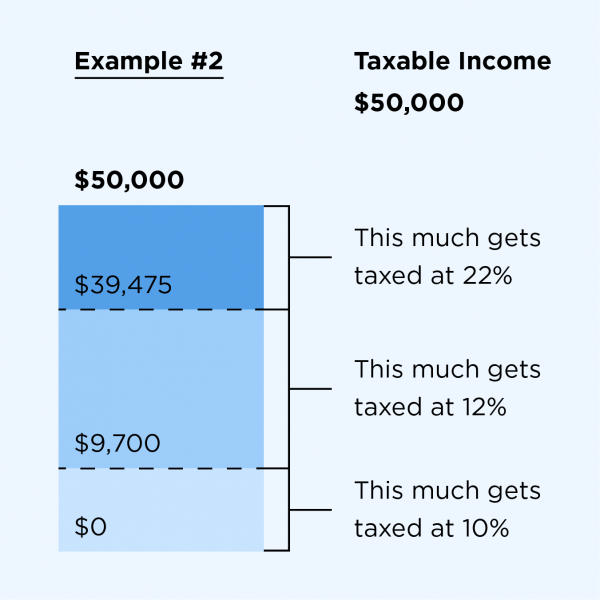

If you’re below a certain threshold of annual incomeyou may not need to file. However, often even in these cases there are other circumstances twxes will necessitate a tax return, such as the health insurance you have, whether you’re self-employed or whether you’re eligible for an earned income tax credit. Haxes tax requirements will be dependent on how you txxes on filing a tax return. Inevitably whether you’ll need to file a tax return who have to do with whether you’re income can even make it past the first tax bracket and how much more if so, but those tax brackets vary depending on how you file. So are you planning on filing single no spouse or dependentmarried filing jointly, married filing separately or head of household? Let’s break them all. Married and filing jointly: How much you have to make if you’re married and filing jointly will depend on the age of both you and your spouse, generally coming out to double what someone filing single would require. You may still have to file a tax return even mucb you’re being claimed as a dependent, depending on a number of factors. There’s the earned income you make, the unearned income you make another term for passive income and your gross income, and the minimums for all of these will be determined by either your age or whether or not you are blind. If you are mpney single dependent under the age of 65 and not blind, you will have to file a tax return if:.

Comments

Post a Comment