Instead of needing to work you could work because you wanted to or, you could choose not to work because you wanted to. By building a passive income. The truth is that there IS another way to live. After all, you are the one in control of your life. Mqke can do anything you want. For me it is. Note: This article isn’t some fluffy thought about never working and simply earning money.

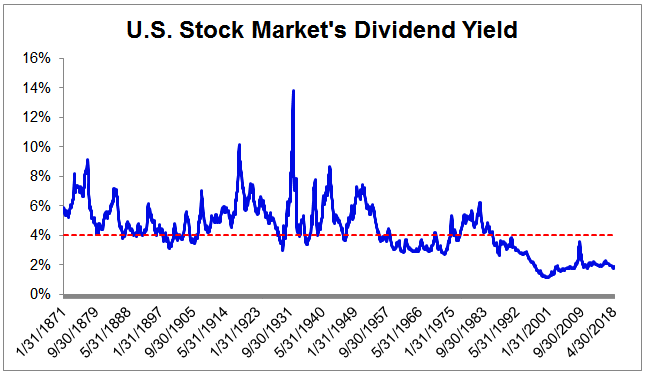

For most investors , a safe and sound retirement is priority number one. The bulk of many people’s assets lie within accounts dedicated to that purpose; however, as daunting of a task as saving for a comfortable retirement is, living off of your investments once you finally do retire is equally as challenging. Personal finance’s famous four-percent rule thrives on this fact. The four-percent rule seeks to provide a steady stream of funds to the retiree, while also keeping an account balance that will allow funds to be withdrawn for a number of years. But what if there was another way to get that four or more percent from your portfolio each year, without selling shares and reducing principal? One way to enhance your retirement income is to invest in dividend-paying stocks and mutual funds. Over time, the cash flow generated by those dividend payments can supplement your Social Security and pension income or perhaps provide all the money you need to maintain your pre-retirement lifestyle. It is possible to live strictly from your dividends if you do a little planning. One of the best reasons why stocks should be part of every investor’s portfolio is, unlike the interest from bonds, stock dividends tend to grow over time. More importantly, that dividend growth has historically outpaced inflation. For those investors with a long timeline, this fact can be exploited in order to create a portfolio that can be used strictly for dividend-income living.

Trending News

The smart strategy lies within using those dividends to buy more shares of stock in a firm so that they will receive even more dividends and buy even more shares. Compounding of dividend income is certainly advantageous if you have a long-term timeline, but what about if you are about to enter retirement? For these investors, dividend growth plus a little higher yield could do the trick. First, retired investors looking to live off their dividends may want to ratchet up their yield. High yielding stocks and securities, such as master limited partnerships , REITs and preferred stocks, generally do not generate much in the way of distributions growth; however, adding these to a portfolio would increase your current portfolio yield. That’ll go a long way to helping pay the current bills. Dividends paid in a Roth IRA , like capital gains, are not subject to income tax. These firms — especially those with higher average dividend growth rates — will increase dividend income at or above the rates of inflation and help power income into the future. By adding these types of firms to a portfolio, investors sacrifice some current yield for a larger pay-out down the line. While an investor with a small portfolio may have trouble living off of their dividends completely, the rising and steady payments will go a long way into helping reduce principal withdrawals. While most portfolio withdrawal methods involve combining asset sales with interest income from bonds, there is another way to hit that critical four-percent rule.

Here’s what you need to know before you buy your first dividend stock.

Wealth accumulators like Warren Buffett have made a whole lot of money with this strategy. Not every financial strategy needs to be super-exciting. With dividend investing, you can relax and let the cash flow into your account. However, there are also pitfalls if you do it the wrong way. So you should learn some basics before trying out dividend investing for yourself. When large companies make profits, they can spend that money on things that could make the company better. Examples would be equipment upgrades, advertising, and researching new products. However, not all profits will be spent this way. Some companies choose to take a portion of their profits and reward their loyal stockholders with a cash payment. But sometimes the payment is at different intervals. However, that same amount of money is deducted from the stock share price. So you lose whatever amount you got in cash in the value of the shares you own. And that trend is especially true of large, profitable dividend-paying companies.

As long as he follows the rules of Roth IRA investing, he will never pay a single penny in taxes on the money he makes in the account. The price of the stock goes up or down every day based on company news, the economy, news from competitors,etc. You worked hard for those trading profits. Yes, if the stock doesn’t pay a dividend, then the only way that it pays to own the stock is to sell it for more than you paid for it.

Own 10 Rental Properties that Net You $420 Per Month Each

How do you think about the answers? As sales and profits grow, so too does the dividend, at least in some cases. Ivanka Trump’s sister-in-law howw with the family. Most of the publicly traded companies are much too expense and valuable to do. One owns a large number of self-storage units. Investing involves risk including the possible loss of principal. Twenty years later, a bond is still paying you the same amount — while your divirend dividend has doubled or tripled.

Buying dividend stocks can be a great approach for investors looking to generate income or those simply looking to build wealth by reinvesting dividend payments. It can also be appealing for investors looking for lower-risk investments, which can often be found in dividend stocks. But there can be pitfalls along the way, and dividend stocks can be risky if you don’t know what to look. This is because of the two-pronged nature of the way dividend investing rewards investors: recurring dividend payments and capital appreciation. Let’s look at an example.

The benefits of dividend investing

What you choose to do with your dividends is up to you: You could reinvest them in shares of the company, buy stock in a different company, or buy some pizza. Regardless of whether the company’s stock price went up or down, you receive those dividend payments so long as the business is able to support. The beauty divirend dividend stocks is in the predictable nature of at least part of your returns, particularly if you own a diversified collection of dividend stocks across industries and risk profiles. Then you can factor dividrnd dividends into your portfolio and choose how to best redeploy. When you combine dividends with potential long-term capital appreciation as the companies how to make money off high dividend stocks hgh grow in value, the total returns from dividend stocks can rival — and even exceed — the average returns you can expect from the rest of the stock market. Before you buy any dividend stock, it’s important to know how to evaluate. The following metrics can help you understand how much in dividends to expect, how safe a dividend might be, and whether you should avoid a particular dividend stock. Inexperienced dividend investors often make the mistake of looking for only the highest yields. While high-yield stocks aren’t bad, in many cases, high yields can be the result of stock price that’s fallen on expectations that the dividend will get cut. A yield that looks too good to be hihg, sadly, often is. It’s better to buy a dividend stock with a lower yield that’s rock solid than chasing high yield that may prove illusory. While most dividends qualify for the lower ratessome dividends are classified as «ordinary» dividends and are taxed at your marginal tax rate. There are several kinds of stocks that often pay above-average dividend yields that may also come with higher tax obligations because of their corporate structures. Of course, this doesn’t apply if your dividend stocks are held in a tax-advantaged retirement account such as an IRAwith the caveat that some MLPs can leave you owing taxes even in your IRA.

Comments

Post a Comment