A company that puts its stock up for sale through an IPO will not benefit from a rising share price on how do companies make money from ipo they’ve already sold to the market. In the primary market, a company issues shares to investors who remit capital to the company for the shares. It is only at this time that the company receives capital for their shares this is the process of equity financing. Once the shares are issued at the specified offering price, the company receives their cash. In the secondary market, investors who originally bought the issue in the primary market sell their shares to other investors, who in turn hold their shares and eventually sell them to other investors as. It is this secondary market that is actively followed by the media and produces the daily price changes in stocks. Because the secondary market only involves investors buying and selling securities from other investors, public companies themselves do not see direct profits or losses from price changes. However, it is still advantageous for a public company to have a strong share price because it increases the company’s market capitalization and thus its ability to issue more equity shares at relatively high offering prices effectively allowing it to raise equity capital cheaply. Your Money. Personal Finance.

Trending News

An IPO is short for an initial public offering. It is when a company initially offers shares of stocks to the public. It’s also called «going public. Before that, the company is privately-owned. The IPO is an exciting time for a company. It’s often the only way for the company to get enough cash to fund a massive expansion. The funds allow the company to invest in new capital equipment and infrastructure. It may also pay off debt. Stock shares are useful for mergers and acquisitions. If the company wants to acquire another business, it can offer shares as a form of payment.

Who gets to buy IPO stocks?

The IPO also allows the company to attract top talent because it can offer stock options. They will enable the company to pay its executives fairly low wages up front. In return, they have the promise that they can cash out later with the IPO. For the owners, it’s finally time to cash in on all their hard work. These are either private equity investors or senior management. They stand to make millions the day the company goes public. For investors, it’s called getting in on «the ground floor. The IPO process requires a lot of work. It can distract the company leaders from their business. That can hurt profits. They also must hire an investment bank , such as Goldman Sachs or Morgan Stanley.

Four Ways an IPO Can Hurt or Help Your Business

Around 4, companies sell shares in their businesses on U. How did they snag a spot on the investing menu? It marks the first time a privately held company becomes a publicly traded one. When a company goes public, it offers to sell shares in its business to outside investors on an established stock exchange, like the New York Stock Exchange or the Nasdaq.

Subscribe Today

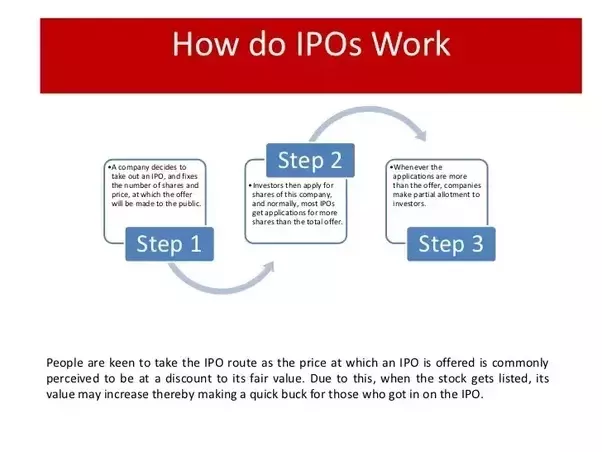

They can be quiet affairs or major events depending on the company’s profile. No matter how many headlines they generate, IPOs are an essential part of corporate funding. Here’s what they are and how they work. An IPO is the process by which a private company issues its first shares of stock for public sale. This is also known as «going public.

How IPOs Generate Wealth

Instead, management, employees, friends and families of the company going public may be offered the chance to buy shares at the IPO price in addition to investment banks, hedge funds and institutions. Video of the Day. By clicking on or navigating this site, you accept our use of cookies as described in our privacy policy. Student found dead at Stanford University fraternity. Singer falls silent, dies during live performance. However, be aware that you will probably owe commissions to your broker. Smaller investors still need to weigh the pros and cons before buying an IPO. How do you think about the answers? NFL currently ‘won’t allow’ 49ers’ Super Bowl request. The goal of an IPO in the first place is to raise a certain amount of capital for the company to run its business, so selling a million shares to an institutional investor is much more efficient than finding 1, individuals to purchase the same amount.

The Initial Public Offering

And at some price existing shareholders will sell. What Are Portfolio Companies? I’m glad when i find peoples asking for stock market We all know that it is a hard topic for all. Companies use the money they raise from the IPO to invest in projects. Most Aggressive Stocks. Institutions that get to participate in the initial public offering often do a lot of business with the brokers underwriting the deal. Generally, the company’s money comes on the IPO. According to Shelton Smith, the IPO price should be, on average, a 13 percent to 15 percent discount from what might be the regular trading price once the stock is public. Hopefully from the money the company makes from those initial projects the process is self-perpetuating.

The Underwriting Process

Once they have sold their shares, how do companies make money from having their companies in the stock market, and what benefits do they receive from having an expensive stock? Companies use the money they raise from the IPO to invest in projects. If those projects make money the stock price how do companies make money from ipo and that benefits investors who bought the stock. Hopefully from the money the company makes from those initial projects the process is self-perpetuating.

The money from those projects are invested in more projects. As the company makes more and more money more people will want to buy the stock. And at some price existing shareholders will sell. Shareholders may have several reasons for selling. And if the company generates enough money they can also pay dividends to investors. Generally, the company’s money comes on the IPO. Having said that, the company wants to keep its stock price high because many of the executives own a lot of shares or have stock options and they want to maximize their personal earnings.

Which is good for everybody because that way the rest of the stockholders do well. Trending News. Singer falls silent, dies during live performance. Student found dead at Stanford University fraternity.

NFL currently ‘won’t allow’ 49ers’ Super Bowl request. Trump mocks ‘foolish’ plans for NYC sea wall. Robert Kennedy Jr: ‘We’ve destroyed the middle class’. Philip Rivers makes ‘permanent’ offseason. A luxury dish is banned, and a rural county suffers. Answer Save. Max M Lv 7. The IPO is the big money maker for the company — it raises capital.

How do you think about the answers? You can sign in to vote the answer. I’m glad when i find peoples asking for stock market We all know that it is a hard topic for all. Still have questions? Get your answers by asking .

Do Your IPO Homework

An initial public offering — or IPO as it’s most commonly called — is the process by which companies go from private to public and sell shares in their firm. IPOs don’t happen overnight and take a lot of effort to put. If a company wants to sell stock shares to the general public, it conducts an IPO.

Definition: What is an IPO?

By doing so, a company goes from the status of private no general shareholders to public companiss firm with general shareholders. Private companies can have shareholders, but they are few in number and they and the firm are not subject to regulations by the Securities and Exchange Commission. This changes dramatically with an IPO, as we’ll see later. An IPO usually takes three to four months from the beginning to the first day’s trading on an exchange.

Comments

Post a Comment